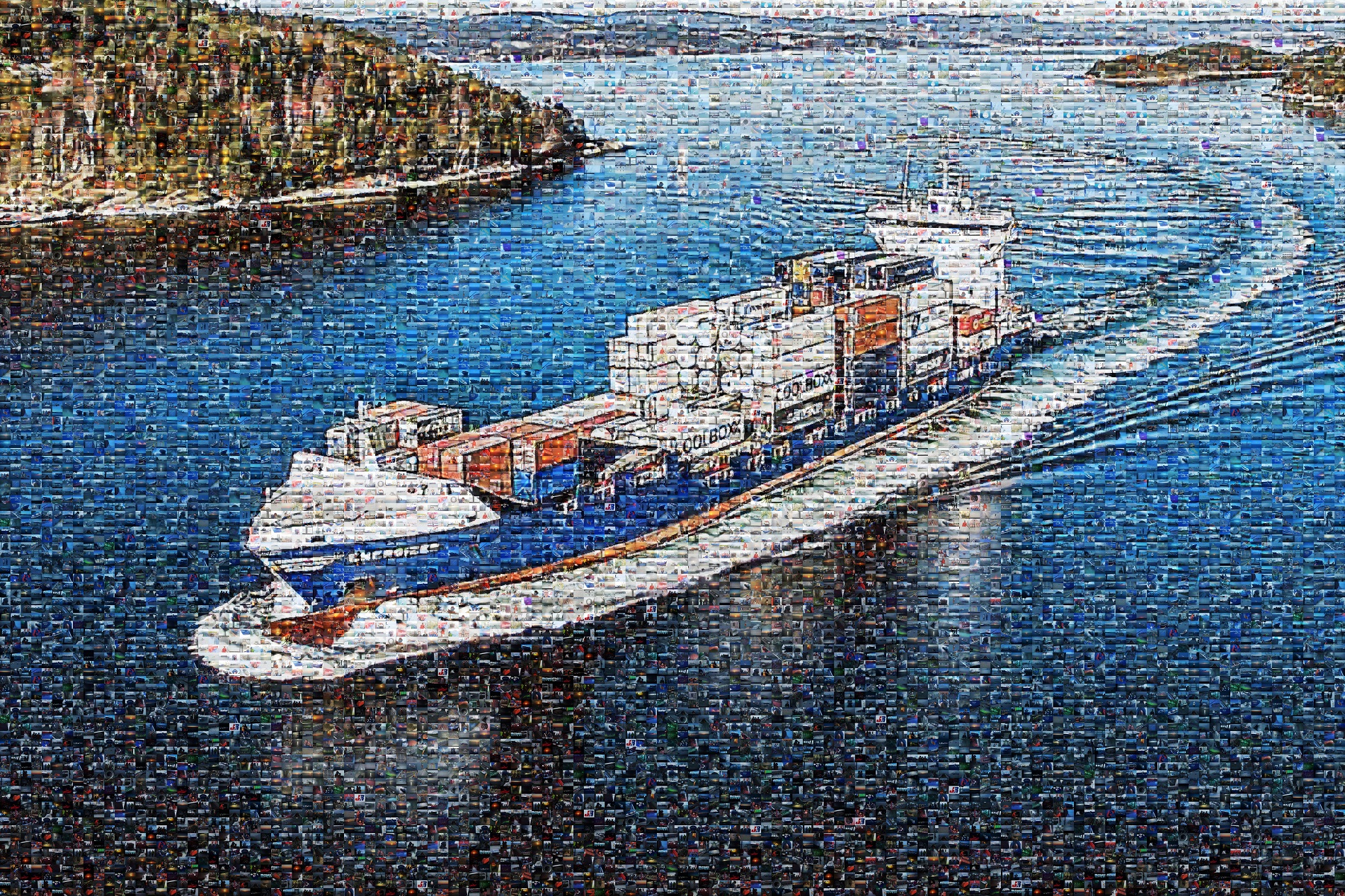

Because of the still disappointing market conditions, JR Shipping marked its 25 years in business with a modest celebration in the company of members of the workforce and former colleagues. In November, a delegation of seamen surprised Managing Owners Jan Reier Arends and Sander Schakelaar with a unique collage, which is suitably displayed in the shipping company building in Harlingen.

In 1993, Jan Reier Arends from Harlingen bought his first vessel, a low-air draught coaster, suitable for short-sea shipping. This marked the creation of founder/owner company JR Shipping. The vessel was called MV Vlieland, however, some letters of the name were overpainted to cut cost and the vessel was rechristened MV Elan. Since then, all the names of the vessels in the JR Shipping fleet have started with the letter “E”. In the first few years, Mr Arends was at the helm himself, frequently accompanied by his wife. Things went so well that, in 1997, Mr Arends was able to buy a new, larger vessel, which was also christened MV Elan.

Focus on the container feeder market

From 2000 onwards, Mr Arends was getting serious about composing his own fleet. He saw opportunities for container feeders in the market and his ideas were supported by Mr Sander Schakelaar, who was the director of a fellow-company in Groningen at that time. Messrs Arends and Schakelaar joined forces and set out a strategy which focussed on the container feeder market. In this specialist short-sea shipping segment, JR Shipping managed to take up a leading position.

Milestone after milestone was reached. In 2001, JR Shipping set up its own chartering company: Confeeder Shipping & Chartering. In 2002, the shipping company placed an interesting order for the construction of six new 750 TEU vessels at a Dutch shipyard, Volharding. The last ship of this series, MV Ensemble, was delivered in late 2005. In that same year, JR Shipping purchased two newly constructed vessels from the German Sietas yard.

Success-determining factors in our own hands, except one

Besides new vessels, the shipping company also purchased existing ones. In order to finance its fleet expansion, JR Shipping put direct “ship participations” on the market. The shipping company thus succeeded in attracting a growing group of investors who, in the initial years, benefitted from good returns on their shipping investments. For the purpose of further professionalising service provision regarding bond issues and fund management, JR Ship Investments was founded in 2007. That year also saw the creation of JR Ship Brokers & Consultants, specialised in buying and supervising new-build vessels. This was in line with the company strategy to keep all success-determining factors in its own hands.

There was one determining factor which the shipping company could not control: the trends in global trade, which is the indicator for the international maritime shipping industry and the container feeder market in particular. The 2008 credit crisis was the forerunner of a worldwide recession, which had a duration and impact that no one had imagined possible. The consequences for the shipping industry and the company policy have been huge and still have an effect to this very day.

Doing business in times of deep crisis

As the result of a policy focussed on fleet expansion, JR Shipping had 23 state-of-the-art vessels in operation. The shipping company adjusted its course towards differentiation and consolidation. To prevent the loss of vessels and invested capital, a series of transitional and restructuring measures were taken. In 2012, eleven container feeders were subsumed in the JR Fleet Fund CV, which seemed to safeguard continuation of operations in anticipation of market recovery.

Indeed, recovery did occur several times, notably in 2010, 2013 and 2015, but every time it proved to be short-lived and inadequate. In a number of cases, ship bankruptcies could not be prevented. The shipping company managed to shelter its suppliers and safeguard performance of its service provision, though. Despite the lingering crisis, Messrs Arends and Schakelaar continued to operate. Their priority areas: consolidation in the container feeder and multi-purpose vessel markets and state-of-the-art operations in the markets for offshore service vessels and ship management services to outside parties. In 2010, within the context of its diversification policy, JR Shipping incorporated SeaZip Offshore Service, which now operates six Damen Fast Crew Suppliers and one survey vessel. In 2011, the shipping company christened two newly built multipurpose vessels, the MV Esprit and MV Estime.

Reconstruction of the fleet

Thanks to resilient entrepreneurship, the shipping company seemingly managed to survive the crisis, operating a fleet of 14 container feeders, 2 multipurpose vessels and 7 offshore service vessels (including SeaZip Fix). Unfortunately, in 2017, the eleven vessels subsumed in JR Fleet Fund CV were confronted with a precarious situation. The bank which held the mortgage for these vessels opted out and thus jeopardized the continuity of operations of the CV. The shipping company succeeded in keeping the vessels from being sold by tying a British financier to JR Fleet Fund. Thus the 2018 jubilee year, of all years, saw the long-delayed farewell which the shipping company and a large group of investors had to say to the prospects of distribution payments. The shipping company kept the management of the vessels, though, so as to lay a new foundation for the future. The partnership with the British financier focusses on acquiring, financing and operating further vessels. Furthermore, the shipping company is engaged in talks with a number of parties and involved in various projects, which we hope will lead to the reconstruction of the JR Shipping fleet in the long term.

JR Shipping in the media

It is obvious that JR Fleet Fund CV has attracted the attention of various media. After all, investors in JR Fleet Fund have lost a great deal of money as a result of the crisis conditions. In addition to just reporting about the actual situation, some media have repeatedly and leadingly paid attention to this complicated process and the Management Board’s considerations. JR Shipping’s Management Board has decided not to react actively to erroneous allegations made in media reports.

Fortunately, the vast majority of the limited partners in JR Fleet Fund CV are able to differentiate between what others write about our shipping group and what the shipping group itself has reported for almost ten years; by way of newsletters directly sent to the limited partners in JR Fleet Fund CV as well as through our annual report JR Shipping Anno Nu, which we publish on our websites www.jrshipping.com and www.jrshipinvestments.nl each year.

JR Shipping will continue to be involved as the ship management company. Our role will be to provide services; a role as a shareholder or something similar is not anticipated for our shipping company. This ship management role provides a basis for the continuity of our organisation and for job opportunities for over thirty staff members ashore and more than two hundred crew on board the ships.

This does not alter the fact that the Management Board deeply regrets the final outcome. We would have preferred a substantial market recovery to have happened far longer ago, so that distributions could have been transferred from Fleet Fund CV to the relevant limited partners.

Unpredictability of shipping markets lasts

Shipping markets are cyclical. Shipping companies through the ages have anticipated this, as described in our latest annual report, JR Shipping Anno Nu 2017. The havoc wreaked in the past ten years, though, has not occurred in the shipping industry before. In late 2017, the sun seemed to break through. Leading analysts considered 2017 as a crunch year and shipping entrepreneurs entered 2018 with moderate optimism. Last year has taught us first and foremost that shipping markets remain unpredictable.

Container feeder market

2018 got off to a good start and all signs pointed to a lasting upward trend. In the summer, though, the charter rates for container feeders came under pressure once again. A number of vessels delivered back by their charterers could not immediately be deployed again. Although the market recovered after the summer, the rate levels in the new charter contracts did not meet our expectations.

Multipurpose shipping market

The lasting recovery which had been announced for the multipurpose market failed to materialize as well. The summer saw a short downswing once again. Since late August, the freight rates have recovered a little, but the extent of the recovery is still disappointing and it is difficult to predict anything meaningful about the development of the market in 2019.

Offshore service vessels

Despite the fact that the market for offshore service vessels has its own dynamics, which are unrelated to the crisis, the developments in this market are also difficult to predict. It is a fact that the offshore wind industry is experiencing a huge growth and generates much work for Dutch businesses. SeaZip Offshore Service managed to benefit more from this in the past year. In 2016 and 2017, the market for offshore service vessels was less profitable. To optimize the deployment and results of its vessels in 2019, SeaZip will continue to intensify its market and sales efforts, which will prompt an expansion of the number of partners. Experience has shown that once project developers have become acquainted with how the SeaZip vessels and their crews perform, they generally place follow-up orders. Opportunities in this market are good and SeaZip is on alert 24/7 to cash in on them.

Focus on continuity, also in 2019

The increasing unpredictability of the global economy and the related developments in the shipping markets require a course in which flexibility is critical. If our shipping company wants to continue playing a significant role, new partnership forms and innovative forms of financing will be crucial. ‘Agile’ entrepreneurship is trending, the focus continues to be on continuity of operations.

‘Agile’ entrepreneurship means, by and large, swiftly and effectively moving in line with the market developments. Since the outbreak of the crisis, JR Shipping has proven that it is able to do so. For example, the issue of specific bonds and the initially successful restructuring of its own shipping funds led to completely new services: ship management and restructuring plans for outside parties.

Expert services

These services generated a number of significant contracts over recent years which contributed to the continuity of our service provision. In the years ahead, expert services for parties such as banks and fellow companies will remain one of the pillars supporting our policy. Furthermore, our activities will continue to focus on the operation and management of container feeders, multipurpose vessels and offshore service vessels. There will be considerable variations in ownership structures here.

New sources of financing

There is no question about it that the shipping industry will have to be more creative than ever in finding new sources of financing. The traditional shipping banks are exercising restraint when it comes to granting mortgage loans. Private and corporate investors’ confidence in ship participations has been damaged due to the performance of shipping funds over recent years. In the time ahead, we will only be able to attract traditional investors by providing very specific opportunity investments. Regaining their confidence will take time. Having said that, a world without a shipping industry is unimaginable, so new financiers will present themselves and JR Shipping, in light of the know-how it has accumulated, will most certainly play a role in it.

Performance, efficiency, safety

The conduct of the British financier who took over JR Fleet Fund’s debt position and decided to subsume the eleven vessels concerned in a new legal form, is one example of the financing and ownership structures which will define the years ahead. It means that the shipping company continues to be responsible for the management of the vessels and the quality, efficiency and safety of the service provision at sea, which is consequently safeguarded.

Together with the British financier and other financing parties, we will continue to explore opportunities and focus on operating more vessels. We do this as short sea shipping experts. In coordination with its business partners, JR Shipping will go on dedicating itself tirelessly to providing the best possible performance to its customers and to regaining investor confidence.